What Are Bonds?

As we plan for retirement, the primary concern for many is security. Nobody wants to outlive their savings or find themselves in a financial crunch in their twilight years. This is where bonds, a cornerstone of conservative investment strategy, play a crucial role. Let’s delve into how bonds can be the anchor for your retirement savings.

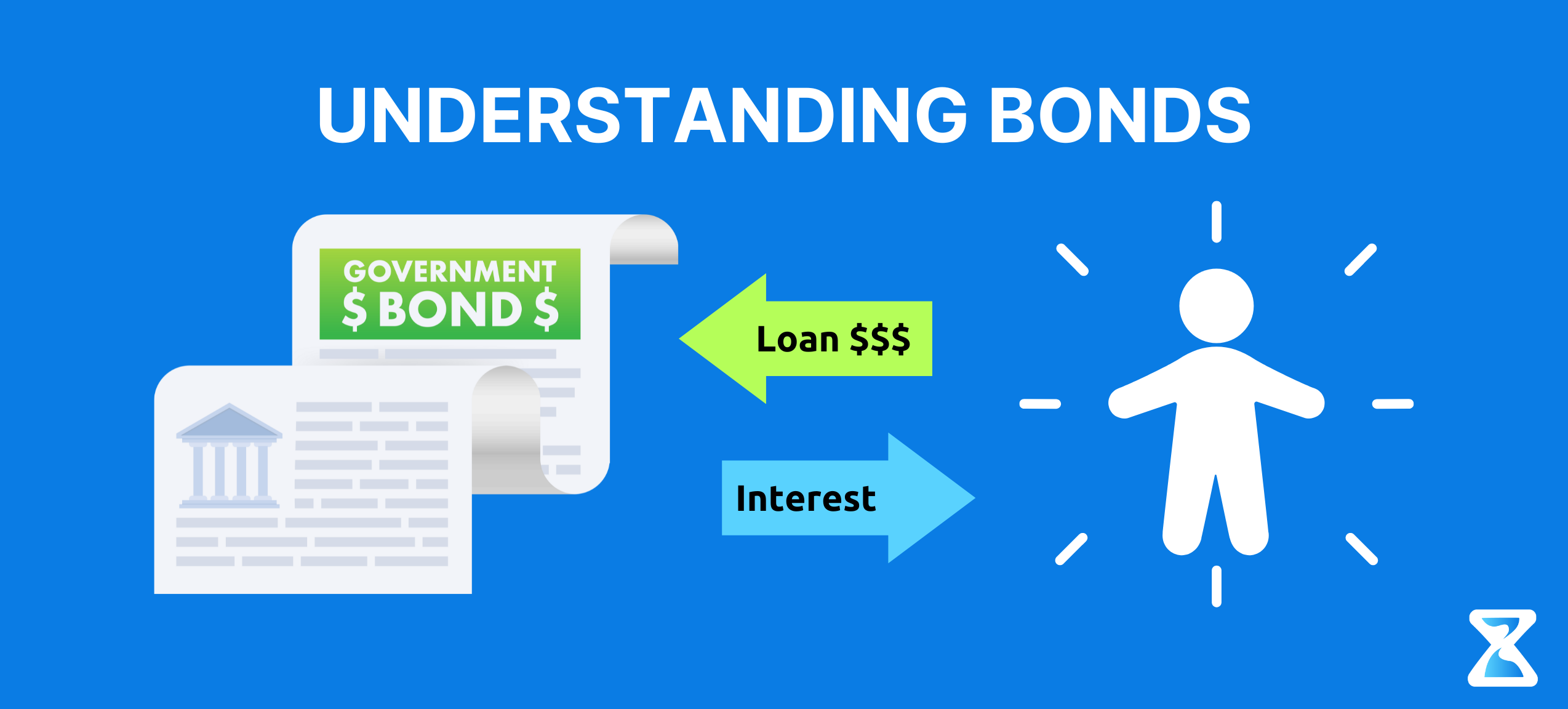

At its core, a bond is a loan that you, the investor, give to an issuer, which could be the government or a corporation. In return, the issuer promises to pay a predetermined interest, known as the bond’s coupon rate, periodically until the bond matures. At maturity, the issuer repays the bond’s face value to the investor.

Why Consider Bonds For Retirement Savings?

- Stability: Unlike stocks, which can be volatile, bonds are generally considered more stable. Even during economic downturns, if you hold a bond to maturity, you’re likely to get back your principal along with the promised interest.

- Regular Income: Bonds provide periodic interest payments, making them an attractive option for retirees who need a consistent income stream.

- Diversification: Bonds can act as a counterbalance to riskier assets in your portfolio. When stock markets are down, bonds often perform relatively better, thereby offering diversification benefits.

Types Of Bonds To Consider

- Government Bonds: These are considered the safest since they are backed by the full faith and credit of a government. They might offer lower yields compared to corporate bonds but are more secure.

- Corporate Bonds: Issued by corporations, they offer higher yields but come with a higher risk compared to government bonds.

- Municipal Bonds: Issued by local governments or their agencies, they often provide tax benefits, making the effective yield attractive for those in higher tax brackets.

Things To Keep In Mind

- Interest Rate Risks: If market interest rates rise, the price of existing bonds falls. This doesn’t impact those who hold bonds until maturity, but if you’re planning to sell your bond before it matures, it could be a concern.

- Credit Risks: Especially pertinent to corporate bonds. If the issuing company faces financial difficulties, they might default on their interest payments or even the principal.

- Inflation Risks: Over time, inflation can erode the purchasing power of bond interest payments.

Conclusion

While no investment is risk-free, bonds offer a relatively secure and steady path for retirement savings. They can provide stability, diversification, and a regular income, essential factors to consider when planning for retirement.