What is an ETF?

Today, we're delving into the exciting world of ETFs – a critical component of modern retirement account asset allocations.

So, what exactly is an ETF?

Think of an ETF as your gateway out of the limited world of single stocks. Say you've always invested in individual companies, like Pfizer. But what if you didn't want to place all your bets on just one company? What if you believed in the potential of the entire healthcare industry? That's where ETFs come into the picture.

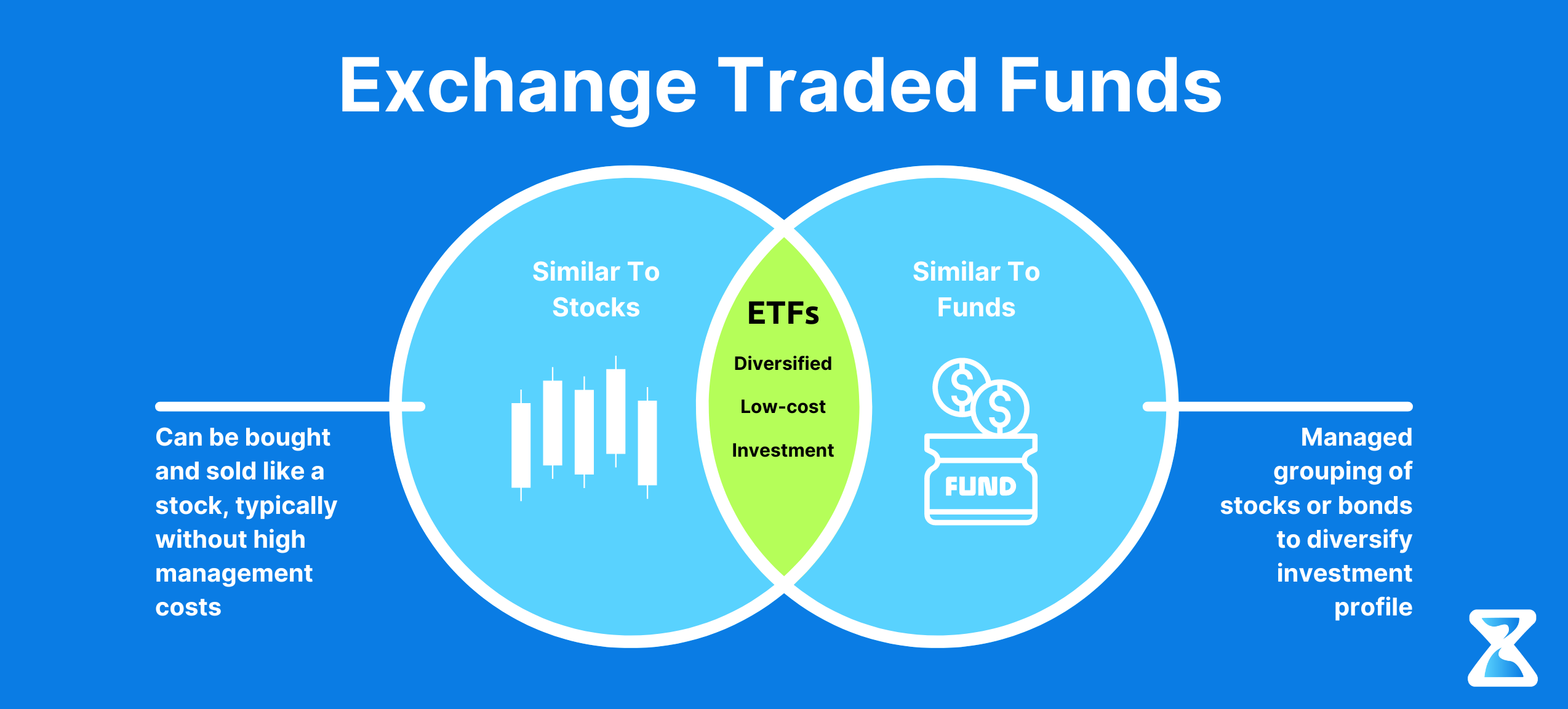

ETF stands for Exchange-Traded Fund. Essentially, it's a collection of various stocks or securities that represent a particular theme or index. You can think of an ETF as a "party pack" of assorted stocks that offer diversification benefits.

Here's a clearer picture using the Pfizer example:

Imagine the healthcare industry is booming. However, let's say Pfizer faces an unfortunate incident, like a chemical spill, causing its stock to plummet. If you were solely invested in Pfizer, you'd be in a bit of a pickle. But if you had invested in a Healthcare Sector ETF, your investment would likely still rise with the industry trend, as the ETF wouldn't be solely dependent on Pfizer's performance.

Different Types of ETFs

The core idea behind ETFs: They allow you to capture broader economic and sectoral trends without having to pick individual winners and there are many different types.

Index ETFs:

Say you admire the companies in the S&P 500. Yet, every time you choose individual stocks from this index, they don't perform as well as you'd hope. Instead of trying to cherry-pick winners, why not invest in the entire S&P 500? Yes, with an S&P 500 ETF, you can.

Inverse ETFs:

What if you believe the opposite? Think the S&P 500 is headed for a slump? Enter Inverse ETFs. These are specially crafted ETFs that rise when the index they track falls. So, an inverse S&P 500 ETF would go up if the S&P 500 goes down.

Commodity ETFs:

Lastly, ETFs aren't just limited to stocks. If you've ever heard your parents discuss investing in gold and envisioned them hoarding gold bars, think again. They were probably referring to gold ETFs – a more practical and liquid method of investing in commodities. Similarly, currency ETFs let you bet on the performance of particular currencies without diving deep into Forex trading.

In essence, ETFs offer a simpler, diversified approach to the often-complex world of investing. They're a fantastic way to capture broad trends, hedge against specific events, or even explore new investment horizons.