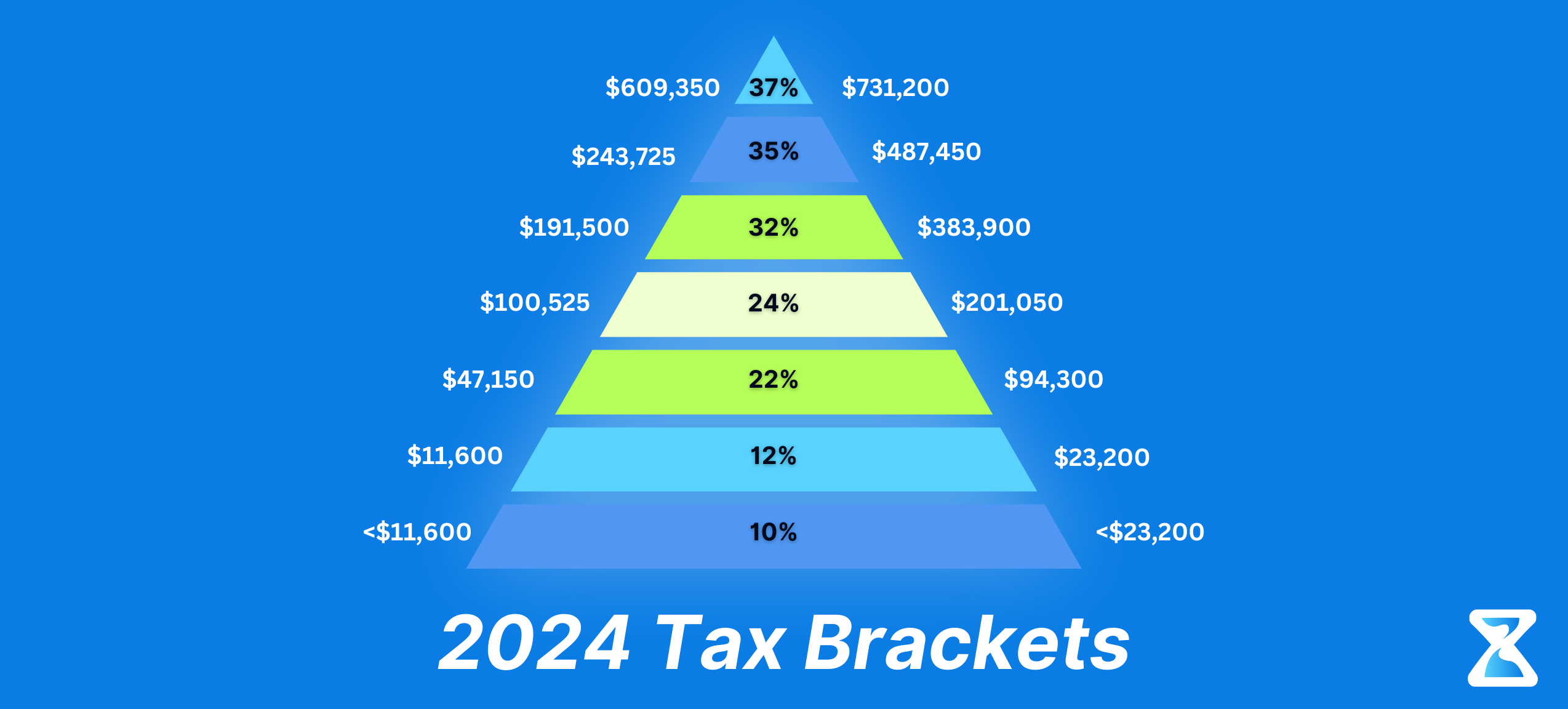

Federal Tax Rates

Tax Rates for 2023

| Tax Rate | Single Filers Income | Married Individuals Filing Joint Returns Income |

| 10% | $0 to $11,000 | $0 to $22,000 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 |

| 37% | $578,125 or more | $693,750 or more |

The Mechanics Of Taxes

Each bracket only applies to income within that range. For example, if you're a single filer making $100,000:

- The first $11,000 is taxed at 10%, resulting in $1,100 of tax.

- Income from $11,001 to $44,725 is taxed at 12%, adding $4,047 in tax.

- Income from $44,726 to $95,375 is taxed at 22%, which is $11,143.

- Income from $95,376 to $100,000 is taxed at 24%, adding $1,110.

Let's compute the sum to get the total tax amount.

The correct total tax calculation for a $100,000 income, using the proper brackets and rates, is as follows:

- $1,100 for the 10% bracket,

- $4,047 for the 12% bracket,

- $11,143 for the 22% bracket,

- $1,110 for the 24% bracket.

Adding these amounts together, the total tax would be $17,400.

How to Work the System

Contributing to a tax-deductible retirement account can be a strategic move to lower your taxable income and, subsequently, your tax liability. When you contribute to traditional 401(k)s or traditional Individual Retirement Accounts (IRAs), you effectively reduce your taxable income for the year of contribution. This reduction could potentially lower your income to a lesser tax bracket, thereby reducing the rate at which your highest dollars are taxed.

Traditional 401(k)s and IRAs

For example, if your income is $100,000 and you contribute $5,000 to a traditional 401(k) or IRA, your taxable income in the eyes of the Internal Revenue Service (IRS) drops to $95,000. This could mean not only paying less tax overall but also avoiding the higher taxes associated with the next bracket if you're on the cusp. It's important to note that while these contributions provide a tax benefit now, they will be taxed upon withdrawal during retirement.

Tax Rates at Contribution vs. Withdrawal

When choosing between traditional retirement accounts (like a traditional 401(k) or IRA) and Roth accounts, it's essential to consider your current tax rate compared to what you expect your tax rate to be at the time of withdrawal:

- Roth Accounts: If you expect to be in a higher tax bracket during retirement or if tax rates increase over time, Roth accounts may be more beneficial. Although contributions to Roth accounts are made with after-tax dollars and do not reduce your taxable income today, qualified withdrawals, which include earnings, are tax-free. This feature can be particularly advantageous if you expect your income to increase in the future.

- Traditional Accounts: Conversely, if you anticipate being in a lower tax bracket during retirement, perhaps due to lower overall income or cessation of employment, traditional accounts might be the better choice. Since these accounts are tax-deferred, you'd pay taxes upon withdrawal, potentially at a lower rate, thus saving on taxes in the long term.

Other Considerations

While tax considerations are significant, they are just one aspect of retirement planning. Other factors to consider include:

- Required Minimum Distributions (RMDs): Traditional accounts have RMDs starting at age 72, which may affect your tax strategy.

- Contribution Limits: These may influence the type of account you choose based on how much you plan to save each year.

- Investment Options: Different accounts offer different investment opportunities and fees, which can impact your returns and savings over time.

Understanding the intricate relationship between your current financial situation, your retirement plans, and the tax implications of different retirement accounts is vital. Remember, the path to a secure retirement is multifaceted, and strategic tax planning is a critical component of this journey.