The 401(k)

Assessing Your Company's 401(k)

Let’s start with the main beast—the 401(k). 55% of non-retirees have one, and likely your company sponsors one too. So for one, it’s accessible; you don’t have to do much to find it. But not all 401(k) plans are created equal. The star students are the ones with high 401(k) matches.

Want to Know If Your Match is Good? Questions To Ask:

[ ] Is it a 100% match, or 50% match, do they even match?

[ ] If they are matching, what percent are they matching to? Common answers 6%,3%,etc.

[ ] What is their vesting period?

Here’s how to digest those answers and find out if they are screwing you over.

Understanding the Match

Lets assume, so we can have baby math, that you make $100,000 a year. Congrats!

Cash Back Match: If you have one, this will mean that they will sweeten the deal by putting the same percent of your salary you put in up to a certain amount.

Let’s use 6% cash back match:

With this, if you put in 6% of your yearly earnings, they will put in 6% too. That’s free money. So, let’s look at how the math there plays out.

Meeting Match

You make your $100,000 and put in 6% of that. That’s 6,000 dollars, and guess who will give you 6,000 more for a total of 12,000? Your company! Take it. Do it. Love it.

$100,000 * .06 = $6,000 + $6,000(company money) = $12,000

But you can put more in also, in fact you can put in up to $23,000 (as of 2024). This $22,500 is what we call an employee contribution limit - and it differs across the accounts.

Contribution Limits: Amount you can put in for a given tax year. This can change too, with marital status – we will cover this later.

So now, if you were to contribute 10% the math would look like this

$100,000 * .10 = $10,000 + $6,000(company money) = $16,000

See, their kindness hits a limit - it's whatever the percentage of your salary they promise. If it were a 3% match they would max out helping you at $3,000. And both of these assume they are matching to 100% - yeah they don’t all do full matching. Watch out for this.

Partial Matches

If it were a 6%, 50% partial match the math would play out like this.

$100,000 * .06 = $6,000 + $3,000(company money) = $9,000

Frustrating Right? So remember, when you vet companies remember to ask these questions. Because, overtime, this shit adds up. This brings us to the final consideration for company plans, the vesting period.

Vesting Period

A vesting period refers to the amount of years you have to be at a company to keep your company match. Unfortunately, you heard that right – KEEP your company match. Yes this sweet, sweet free money deal has strings – surprise, surprise. What often times companies fail to mention is that they may not give you your match if you leave before they want you to and this is different from company to company. To us (on your side) this looks like a way for your company(not necessarily on your side) to either: get out of having to match your money or keep you stuck there longer to improve their retention rates.

Get a deeper dive on types of vesting periods here.

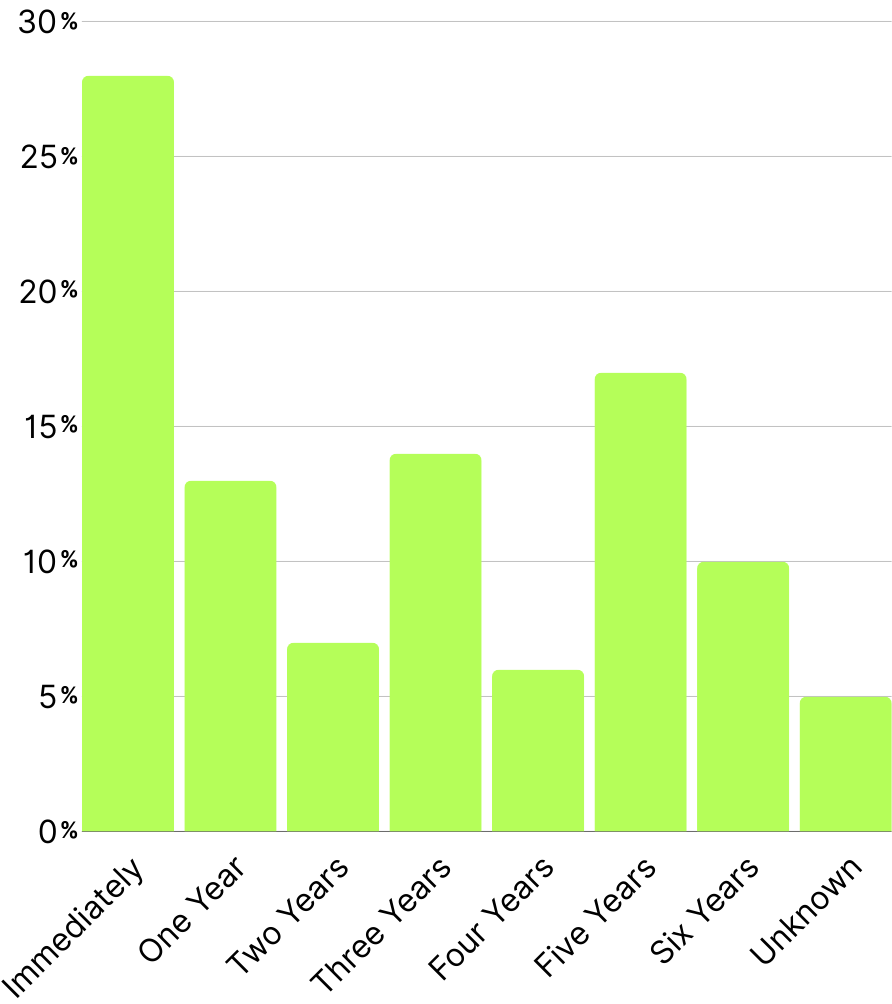

Average Time for 401(k) Vesting, Source: CNBS Employee Benefits Survey

Rollovers

One final pitfall we are going to pull you out of the way of – Rollovers. Now imagine this, you stay at the company for your full vesting period and you say sayonara and find a new job that’s gonna give you a gorgeous 6% 100% match with an immediate beautiful vesting period and ride off into the financial sunset. Your new company doesn’t automatically have your 401(k) sitting and waiting for you. You have to roll it over. More work woohoo!

Do you know how many people forget this step – a lot. Company Capitalize shares that the amount of abandoned 401(k) accounts is 25 million. ARE YOU KIDDING? That’s your money, and we are NOT going to let you leave it. Remember we are disciplined here! The good news is that most companies don’t set it on fire if you forget, but neglecting this orphaned account means that there’s no financial management. As a company focusing on maximizing retirement account earnings with proper attention to asset allocation, at Wizard this is our nails on the chalkboard. So remember to rollover, your 401(k) and bring it with you.

We also have an article to learn more about rollovers - it is right here if you would like to check it out.

Taxation

| TAX BRACKET/RATE | SINGLE | MARRIED FILING JOINTLY | HEAD OF HOUSEHOLD |

|---|---|---|---|

| 10% | $0 - $11,600 | $0 - $23,200 | $0 - $16,550 |

| 12% | $11,601 - $47,150 | $23,201 - $94,300 | $16,551 - $63,100 |

| 22% | $47,151 - $100,525 | $94,301 - $201,050 | $63,101 - $100,500 |

| 24% | $100,526 - $191,950 | $201,051 - $383,900 | $100,501 - $191,950 |

| 32% | $191,951 - $243,725 | $383,901 - $487,450 | $191,951 - $243,700 |

| 35% | $243,726 - $609,350 | $487,451 - $731,200 | $243,701 - $609,350 |

| 37% | $609,351+ | $731,201+ | $609,351+ |

2024 Tax Brackets, Source: IRS

Tax time! You wouldn’t believe how pivotal the tax conversation is to retirement account optimization, which like contribution limits is different for each account type.

With a Traditional 401(k), you don’t pay taxes on the money now. Let’s say we want to max out our company match, get every additional penny they will give us once again. Remember, THAT’S FREE MONEY BABY. Now, let's also say our great company is a 6% 100% 401(k) plan. For this example, you will make $50,000 (sorry for the demotion).

$50,000 * .06 = $3,000 + $3,000(company money) = $6,000

Here, we put our $3,000 in the account BEFORE the tax man comes knocking on our door. To the government, we now have $47,000. Based on current tax brackets that brings us a bracket down! At $50,000, the federal government had us paying in the 22% tax bracket, then the state takes its cut (depends on the state), and FICA and local taxes eat some more of it. Now, at $47,000, we are in the 12% tax bracket, so the whole value of taxes is marginally lower. And our $3,000? The government doesn't tax this money and lets it grow untouched, she's safe – for now. Based on investments, this money can grow and grow safely, until you try to take it out. Say we don’t add any more, we wait for the vesting period; we drag this nest egg with us to companies, and then when we turn the withdrawal age, and the money has grown, we pay taxes. So it's not a miracle tax-free gift; there is a day of reckoning.

Sidenote: With 401(k) accounts, you have to start taking withdrawals from the account at 59 1/2 (current 2024 law), which is the penalty-free withdrawal age. On the other hand, by 73 you are REQUIRED to take distributions annually. These are called RMDs or required minimum distributions.

Back to the day of reckoning – now, when we pull money out, they take the taxes on the withdrawals. The key is that you now pay taxes based on your CURRENT tax rate. Let's say at 60, you now make $250,000; now, the taxes you have to pay on this would put you in the 35% federal tax rate, then state, local, etc. Hurts a litttleeee bit more huh? On the flip side, if you now make $10,000, you are in the 10% tax rate, and you pay less than you would have back when you put in your $3,000.

Time for the string of other variables that makes this confusing!

Some other factors to think about here is that we don’t know what the tax rates will be when we are 60, so this option is a little bit of a mystery. But guess what else? Not only do we have our $3,000, we also had our company match of $3,000 – which, if we have been investing, should have benefitted from growth with compound interest. Additionally, we have been looking at a single person; when you get married, your tax status changes too. All of these variables and more stop this from being a simple discussion.

Sidenote: Taxes are complex and difficult, so we tried to distill it here, but for further detail, go visit our article, Taxes 101.

The Roth IRA

Assessing the Roth IRA

Welcome to the world of Roth IRAs. While it is our job to be your unbiased pilot through this thing, we do have to admit we have a gentle love for the Roth IRA. In most ways, it is EXTREMELY different from the Traditional 401(k). Let’s start with that first word – Roth. Remember our taxes talk? Well, Roth is basically a word that means that we are going to flip the entire concept. Woohoo! With Roth accounts you are basically ripping the tax band-aid off early, you pay the taxes now.

Let’s say, you are back to your $100,000 dollar salary and you have decided to still put in $6,000. Good for you. This time, when the tax man swings around you will not be taxed at $94,000, no, you are paying taxes on a fulllll $100,000 salary. But then that’s it. That money in there is all yours and when you take it out…no taxes. BOOM! So, who is this better for? One group would be people who will be in a higher tax bracket when they turn 59 ½ or older they can take that money out completely tax-free – or they can let it sit forever. Catch that? Another divergence from our 401(k), is that there aren’t RMDs, the government doesn’t make you pull out a certain amount every year, your money can keep growing untouched.

So what are the drawbacks on this account? Well, for one, with a Roth IRA you can indeed be too tall to ride this ride. What I mean by this is if your Modified AGI (MAGI), income excluding tax-exempt assets, is over $161,000 a year (as of 2024) as a single person you cannot contribute to these accounts. Eat the rich I guess!

| Filing Status | MAGI | Max Contribution |

|---|---|---|

| Single | Less than $146K | $7,000 |

| $146K to less than $161K | A reduced amount | |

| $161K or more | $0 | |

| Married filing jointly | Less than $230K | $7,000 |

| $230K to less than $240K | A reduced amount | |

| $240K or more | $0 |

2024 Modified Adjusted Gross Income, Source: IRS

This chart also shows a key difference between 401(k)s and IRAs: They have wildly different contribution maximums. For 401(k)s, the contribution limit, as previously mentioned, is $23,000. With Traditional and Roth IRAs, you can max out at $7,000 in 2024. Bummer, we know.

So whyyyyy are we so peachy on Roth IRAs. To understand this, it is important to first understand the compound growth structures of these accounts over the years. You will often hear people refer to your retirement accounts growing over time – but sometimes we forget to stop and say, well, what on earth is making it grow? The financial markets! Our bread and butter too, might we add. All of these accounts use the income you put in (our trusty $6,000) right back into the market. Through your various investments, your account can either grow – or, guess what, it can totally tank. It depends on the market.

So who chooses? And what can you choose? And how do you know what to choose? The fun answer I’m sure you are used to by now is that it depends on the retirement account type.

However, to simplify it with 401(k)s, you have a few set options, while Roth IRAs benefit from FAR more flexibility to choose how you invest it. As former Wall Street investors in the financial space, we know the ins and outs of how to use that flexibility to create extremely high-performing asset allocations. In our 2022 model stock portfolio, we had returns of 321.31% while one of the leading indexes(S&P 500) had returns of -19.64%. A pure stock portfolio, however, has even more freedom and takes even more risks, so this isn’t apples to apples. However, it should show you one thing – we know our shit. In 2022, average 401(k) accounts dropped -20.5% and IRAs dropped -23.3%.

While many say this is just a natural ebb and flow, simple active account management could have mitigated a lot of these losses. Wouldn't you rather just flow? Also, this is not just for younger individuals with time to recover but for people who need that money to live off of now. More than ever, we believe stepping outside of cookie-cutter plans, is an undervalued way to pull people out of this long-term financial certainty. One way to know that we are right, that we are on your side, is to look at what the financial advisors are doing. Do you think they are using generic formulas that just barely cut it? No, they are doing the type of asset allocation we want to democratize and show you. You earn, we show you how to deliver high returns.

To show how important these returns are, we will change only the rate of return. Over a 40-year time span, changing only the rate of return will show you the magnitude of the difference.

| 4% | 5% | 6% | 7% | 8% | 9% |

|---|---|---|---|---|---|

| $712,691.37 | $905,998.31 | $1,160,714.74 | $1,497,263.34 | $1,942,923.89 | $2,534,118.34 |

5% difference becomes a 1.8 million dollar difference. This stuff is powerful and it matters.

Asset Allocation

From here, we hope you can see the value in prioritizing returns and want to join us to learn more about how this is done through asset allocation.

Going back down to the basics, we have several retirement account components for asset allocations.

Stocks

These are typically thought of as shares in a company and you typically associate them with active trading. For retirement accounts, they are the same thing but you should think about them differently for this type of hold period. Heres how we see it, you want stocks in a retirement portfolio that are going to rock not just for a little but for a long time, something big and sturdy and with potential to grow. In the short term, you might want to jump on a fad, like ozempic for example, and ride it. For long terms we want the best leadership, most room for growth, and big enough size to not be crazy. So what we do is give you those high earning picks and you choose to add them to the portfolio – or don’t.

Bonds

Bonds are like stocks’ weird nerdy cousin. Traditionally they far more safe and reliable, but nothing too exciting. And notice I say “traditionally,” it's intentional because recently, lack of faith in the government has pulled into question the reliability of government bond fulfilment. While that whole mess might not be clear, that’s where we come in. Researching these macro trends, we can help you jump out of the way of things like this that threaten the markets.

Back to bonds, and not the questionable state of the world. Bonds are typically loans you make to earn interest from an organization, so investing in these markets typically means reliable returns. When the money is in your retirement account, you can 't touch it anyway, so you might as well lend it out and make some dough on it.

ETFs

ETFs are a way to bundle both of these groups. Yes, bond ETFs and stock ETFs and many more under the umbrella. I like to think of them as a cluster of related stock that hones in on one group commonality. For example, there are 11 market sectors, and there are sector ETFs that allow you to bundle a group from that sector – say a technology ETF. If you think the technology sector is going to be a good long term bet you can do an ETF here. Benefits of this are, say you instead just invested in Meta. Well, if you do this and long term technology goes up as a collective but meta explodes because of the next scandal you don’t take the same gains as the Tech ETF guys.

Why 60/40 doesn’t cut it

So heres whats traditionally been done, companies have generically laid it out like this prepackage conglomerate of stocks and bonds in a fixed ratio. You may have heard of the 60/40 formula, which simplifies to assume stock means risk and bonds mean safety. Through our bond analysis just a step ago we realized this isn’t always true. In 2022, an average of 20% of life savings were lost on this assumption. Now as always, we note that there are ebbs and flows, but to a certain extent, don’t you want to make your money work smarter not harder?

Anyways, this world of IRAs allows you to take more of a driver’s seat in this process and the roth element allows you to have complete ownership of your nest egg.

Traditional IRA

Traditional IRA

This is the Traditional version of the Individual Retirement Account. If you earn money from working, you are allowed to contribute money to an IRA. There are two tax benefits to placing money into an IRA: contributions are tax deductible (if you or your spouse do not have active 401(k) plans; and the money in the account grows tax-deferred. It’s just that simple.

You can withdraw money from your IRA any time, but if you are less than 59 ½ years old, you’ll have to pay a 10% penalty on the money you take out. And like the 401(k), you must pay ordinary income tax on any money withdrawn. The idea is to put money into this bucket with the intention of letting it grow there until you retire later in life.

Benefits

First, you can open a Traditional IRA at most any bank or brokerage firm. As with the Rollover IRA, we suggest you choose a firm that offers zero-commission trading and has a broad spectrum of investment options. If you do this, you’ll immediately receive the benefit of LOWER FEES. Who doesn’t like lower fees?

Like the Roth IRA, you’ll also gain the most important leg up: a myriad of investment choices, including stocks, bonds, mutual funds, and ETFs. This is critical if you hope to implement thoughtful and strategic investment strategies. Flexibility is key, my friends.

And of course, the tax-deferred environment is a wonderful benefit. Again, like the 401(k), trades and strategies that yield dividends, interest, and capital gains are tax exempt. Nice.

At Wizard, we love the freedom provided by the IRA. It allows us to really do our thing, which is building portfolios and strategies the GROW. We can blend a portfolio of great stocks, allocate to the best performing sectors, and when necessary, sell everything and get out of the way of a difficult market.

But a note of caution. We typically do not use an entire IRA to trade aggressively in stocks. Sure, it makes sense to trade in an IRA, as we can do so without capital gains implications. However, should you trade badly and (yikes) lose all of your money, you have to start all over again, losing the tax benefits gained through contributing to your IRA over time. So, we play it smart.

The Roth 401(k)

A Roth 401(k) is a retirement savings account that is funded with after-tax dollars. This means that you pay taxes on the money you contribute to the account upfront, so you won't have to pay taxes on the money you withdraw from the account during retirement.

One of the benefits of a Roth 401(k) is that it is more likely to have an employer match than a Roth IRA. This means that your employer may contribute a certain percentage of your salary to your account, which can help boost your retirement savings.

However, unlike other retirement accounts such as traditional 401(k)s or IRAs, a Roth 401(k) doesn't offer as much customization in terms of investment options. Additionally, some employers may not offer a Roth 401(k) option, so it's important to check with your employer to see if it's available and if it makes sense for your retirement savings strategy.

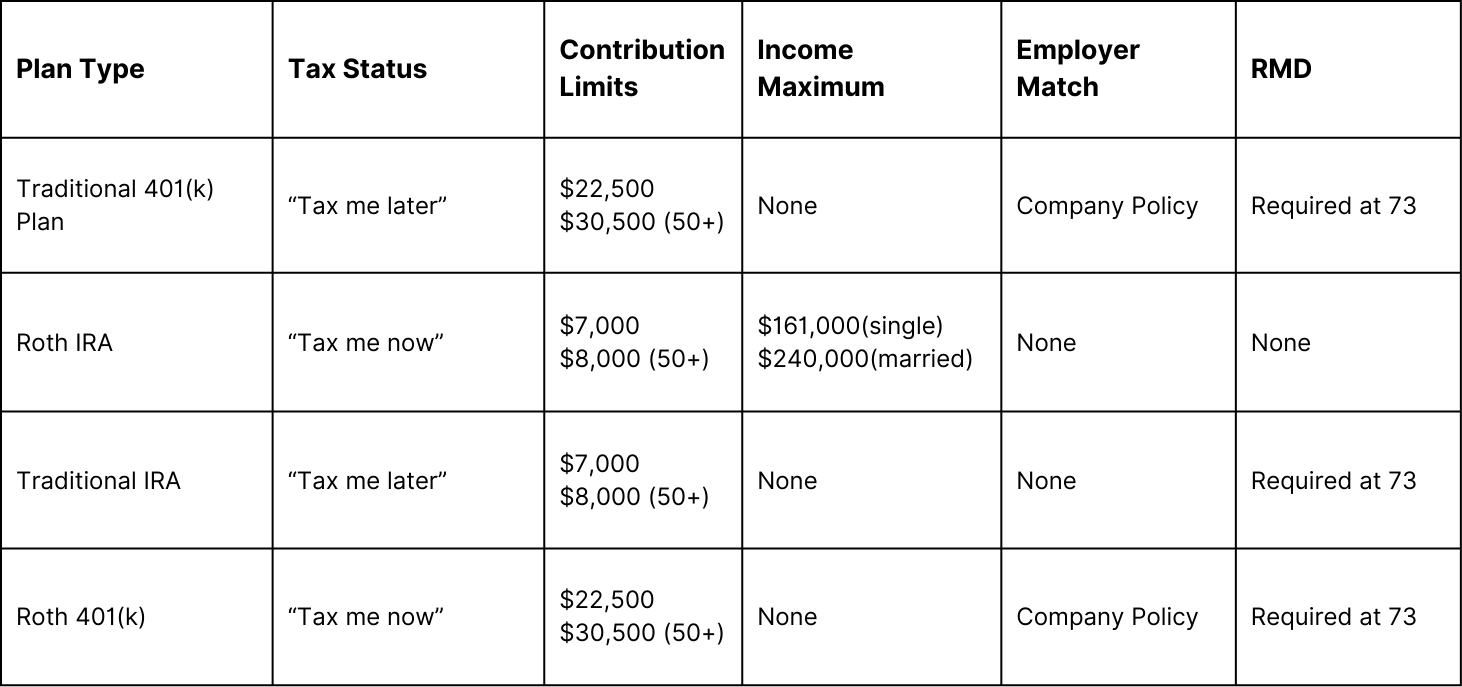

To make all 4 of these accounts clearer and reinforce what we have discussed, we have prepared a chart that highlights all the key attributes that differentiate these accounts.

SUMMARY

We have covered some of the primary retirement accounts available to help you get to your retirement goals in the quickest, most tax-efficient way possible. We hope you better understand the landscape now, and we promise that Wizard will continue to educate you as best we can. We will also help you stay up to date on any legislative changes that may affect these different accounts.

Selecting which accounts are right for you and funding them is only part of the process. That’s the boring part. Now you get to participate the beautiful and exciting world of investing. The thrill of buying stocks. The fascinating study of markets, economies, and global macro events! You get to run with the big dogs and turn your thousands of dollars into hundreds of thousands of dollars. That’s where Wizard comes in.

In our monthly reports, we will share with you the insight of experienced traders who have dedicated their lives to making the right moves in the markets. You can use our reports to help make prudent adjustments to your retirement accounts and maximize your returns. We’ll help you avoid some of the pitfalls and mistakes along the way. Most importantly, we’re going to have some fun along the way!