WELCOME TO THE LEARNING CENTER.

Whether its a quick refresher or full-blown Retirement 101, we want to arm you with all the tools to become retirement-ready.

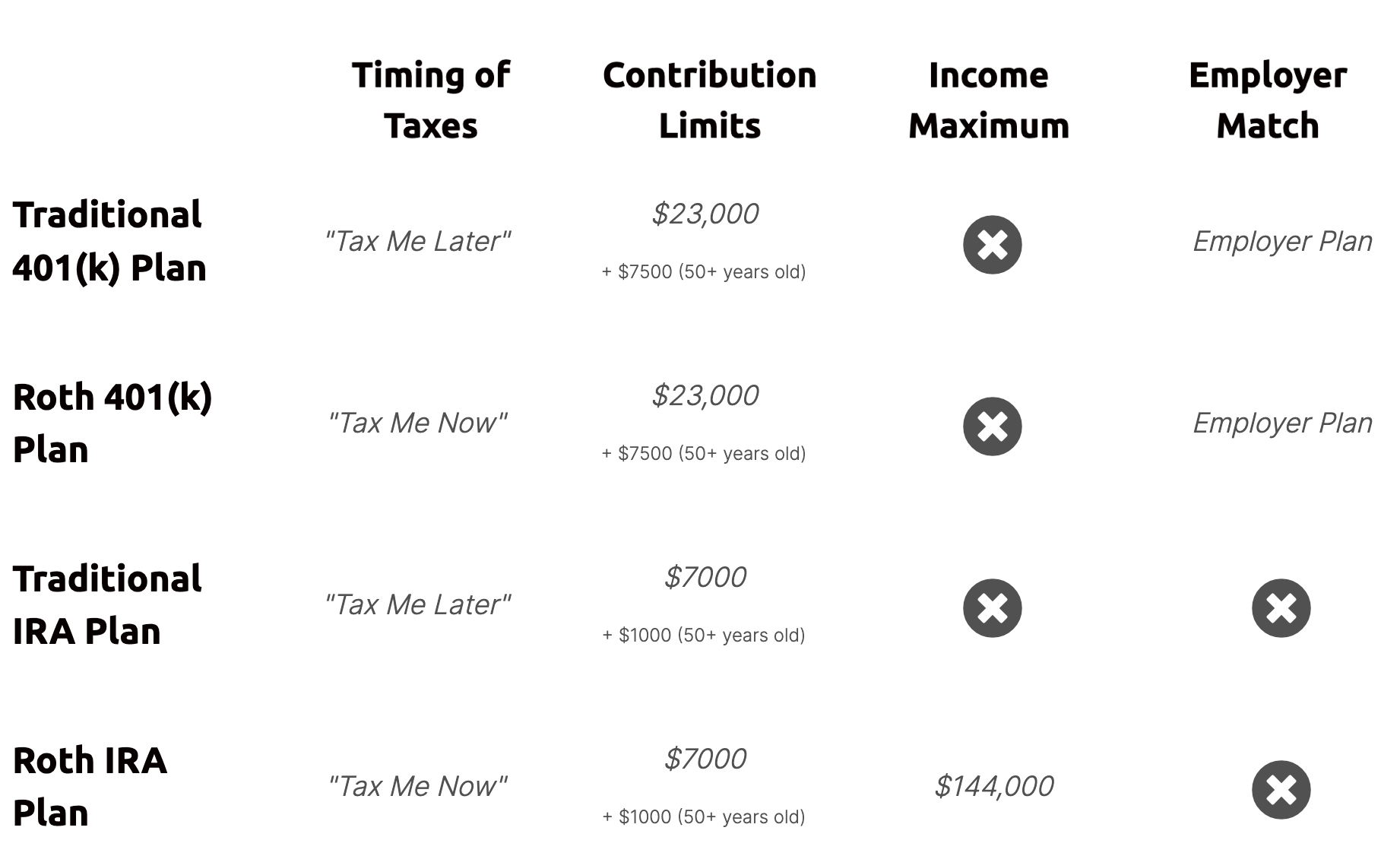

Chart Comparing Retirement Account Features (calculated for single filer, 2024)

Timing of Taxes

Contribution Limits

Income Maximum

Employer Match

Traditional 401(k) Plan

"Tax Me Later"

$23,000

+ $7500 (50+ years old)

Employer Plan

Roth 401(k) Plan

"Tax Me Now"

$23,000

+ $7500 (50+ years old)

Employer Plan

Traditional IRA Plan

"Tax Me Later"

$7000

+ $1000 (50+ years old)

Roth IRA Plan

"Tax Me Now"

$7000

+ $1000 (50+ years old)

$144,000

**This is just for quick viewing click here for a full breakdown of retirement account comparison

WELCOME TO THE LEARNING CENTER.

Whether its a quick refresher or full-blown Retirement 101, we want to arm you with all the tools to become retirement-ready.

**This is just for quick viewing click here for a full breakdown of retirement account comparison

Ask A Question

Didn't find an answer to your question in our learning center? Let us help.

Enter Your Question and Email, and we will notify you when your question is answered by our professionals!